As a counselor I look at A LOT of credit reports, and I have concluded that we need to implement a course in High School: You & Credit 101

It is a sad state of affairs that our people find themselves, they seem to be managing life well

until the day they decide they want to buy a home.

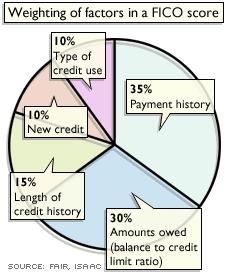

I am here to share some of my knowledge regarding this matter. Credit rating only matters

if you are trying to get a home by using other peoples money, primarily…banks. In that case you will want to have the best FICO score somewhere over 680. (FICO stands for Fair Isaac Company that originally created a tool for lenders to use in evaluating the risk associated with lending you money).

So let’s say you have scores in the 500’s, be prepared to put 15-20% down when purchasing a home.

For a credit score to be calculated, your credit report must contain at least one account that has been open for six months or more, and at least one account that has been updated in the past six months.

As your score improves, you will be able to get higher credit limits and loan amounts. If you demonstrate that you are reliable by always paying your bills on time, your credit score can improve significantly. BE PATIENT with yourself.

Here are some tips:

#1.Correct blatant mistakes. Your credit score is only as good as what shows up in your credit report. Review your reports from all three credit bureaus for accuracy once a year as well as several months before applying for a loan. Changing a mistake on your report – such as a payment that is wrongly labeled as late — can take 30 days to three months, sometimes longer.

#2.Pay your bills on time. This is always a good practice.

#3.Reduce your credit card balances. A heavily weighted factor in your FICO score is how much money you owe on your credit cards relative to your total credit limit. Generally, it’s good to keep your balances at or below 25 percent of your credit card limit.

#4.Pay off debt rather than moving it around. Since the ratio of your credit card balance to your credit limit is key, closing out an account and transferring the balance simply means you increase that ratio, which is likely to lower your score. In other words, say you owe a total of $2,000 on four credit cards, each of which has a $2,000 limit. Your total credit limit is $8,000, of which your total balance ($2,000) accounts for 25 percent. If you transfer all your balances to two cards and cancel the other two, your total credit limit is reduced to $4,000, and your $2,000 balance now accounts for 50 percent of that limit.

#5.Don’t close unused credit card accounts near loan time. If you have several credit card accounts but are only using a few of them, you’ll only raise your balance-to-limit ratio if you close the unused ones. You also shouldn’t open new accounts when applying for a loan if possible. If you have a short credit history or very few accounts, opening a new credit line may lower your score since you don’t have a proven track record. What’s more, a new account will lower the average age of your accounts, another factor in your FICO score.

Daisy Says: Treat your credit like a treasure, because it is.